Money Matters

Distributor Statistical Comparisons: Benchmarking Crucial Profit Variables

By John Mackay

THE ANNUAL MHEDA Distributor Statistical Comparisons (DSC) study is a process of benchmarking the costs of what distributors experience. The result is a business case for making changes to improve return on investment in your business.

The DSC analysis includes the traditional business benchmarking you would expect; return on investment, income statement costs and margins, balance sheet comparisons, financial ratios, asset productivity ratios and employee productivity.

Many owners of closely held businesses believe they are so closely involved with all facets of their operation that there is no need to participate in an industry benchmarking study. However, if your company wants to increase profitability and continue to grow in today’s competitive environment, sometimes your best instincts may not be enough, and, without an industry benchmark, they’re only instincts.

The MHEDA DSC Report is one of the best and most comprehensive financial benchmarking tools available to help distributors better manage their business to be more profitable. From past DSC Reports, we know that one of every four material handling distributors earns twice the return on investment as the rest of the industry. Wouldn’t you like to know how they did that?

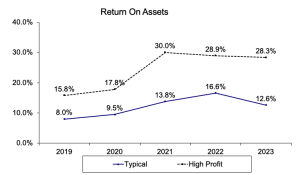

“High-profit” distributors in the exhibit above are defined as one of every four distributors that participated in the DSC Survey, based on return on assets (ROA). In other words, 25% of MHEDA members earned incredible profits. If one in four distributors can earn 20-30% ROA, that should be a realistic goal for all material handling distributors.

“High-profit” distributors in the exhibit above are defined as one of every four distributors that participated in the DSC Survey, based on return on assets (ROA). In other words, 25% of MHEDA members earned incredible profits. If one in four distributors can earn 20-30% ROA, that should be a realistic goal for all material handling distributors.

In addition to the usual income statement and balance sheet benchmarks, the industrial truck DSC study also takes a much deeper dive into the analytics for five distinct departments:

Aftermarket Operations

Aftermarket operations is the add-on revenue source from industrial truck equipment sales and parts, service and rental fleet operations. The goal is that aftermarket gross profit covers 100% of the entire company’s operating expenses.

Sales Department Analysis

The equipment sales department analysis benchmarks the productivity and profitability of selling new and used material handling equipment. The sales department analysis profiles sales staffing, sales employee productivity, product mix, gross margin by product category and inventory performance for equipment. Without these sales productivity and profitability benchmarks, your business could easily produce disappointing results.

Parts Department Analysis

Just over 20% of an industrial truck distributor’s revenue is generated by parts. Let’s face it, once a customer chooses a supplier for power equipment, they probably purchase their equipment parts from the same supplier without shopping around. However, if you overprice parts, the customer may decide to shop around for parts and ultimately switch suppliers for equipment as well. That is exactly why you need industry benchmarks – to know what is competitive yet profitable.

Service Department Analysis

The service department is possibly the most rewarding and the most crucial section in the DSC report. Service is a high- margin business. The service department contributes more to a dealer’s bottom line than any other department. Knowing what technician staff levels you need and the appropriate productivity expectations for that staff is critical to your business.

Rental Department Analysis

In addition to selling and servicing material handling equipment, most dealers rent equipment. While profitably managing a rental fleet is important, the capital investment associated with that rental fleet is significant. The rental department analysis provides you with profitability benchmarks, and it also presents benchmarks on the capital investment needed.

Crucial Profit Variables

Benchmarking distributor performance reveals the gap between planning and execution. It also helps companies identify potential problems and areas for improvement. Critical profit variables (CPVs) are key metrics for your operations management, customer service and financial viability. Despite the importance of the CPVs for success, many companies wonder how to put performance metrics in place and make them work in practice.

The MHEDA DSC Report provides concrete benchmarks to understand how highly successful material handling distributors managed the critical profit variables of their business just a little better, resulting in a lot better ROA. The key CPVs are the decisive benchmarks that separate successful companies from other distributors in the industry.

How Can DSC Help?

It isn’t surprising that companies find it tough to compete in the material handling industry. Businesses not only have to sell equipment, but they need to stock parts, train a service network and invest in a rental fleet. Doing all of that presents a myriad of challenges. The DSC Report provides the benchmarks needed to guide you through those challenges and be more successful.

There are three DSC studies, one focused on industrial truck distributors, one concentrated on storage and handling distributors and one dedicated to systems integrators. The DSC surveys launch in early January.

In summary, the MHEDA DSC Report is a profitability study designed to obtain, understand and analyze best practices in the material handling industry. More importantly, the DSC Survey is designed to help you improve your own financial performance.

Participate in the DSC study so you know if you are on the right track!

About the Author

John Mackay is the managing director of Mackay Research Group, a survey research organization that specializes in profitability and compensation research for trade associations, including the MHEDA DSC study. He can be reached at john@mackayresearchgroup.com. Stay tuned for Mackay’s next DSC article as it relates to additional sectors within the industry.