By Dr. Albert D. Bates

The North American economy is slowly, but systematically, gaining momentum. The challenge in moving forward is to ensure that firms don’t let their exuberance to regain sales volume prevent them from making profit-based decisions.

Firms have five Critical Profit Variables (CPVs) at their disposal: sales growth, gross margin, expenses, inventory, and accounts receivable. In managing the CPVs there are always ongoing trade-offs. For example, increased sales will probably necessitate more accounts receivable. Managing the trade-offs well is the key to success.

This report will provide a reminder of the interaction between the different CPVs. It will do so from two distinct perspectives:

- The Profit Impact of the CPVs: An analysis of which CPVs drive higher profit higher and faster.

- Developing Trade-off Strategies: An approach to combining the CPVs in a way that maximizes profit for the firm.

The Profit Impact of the CPVs

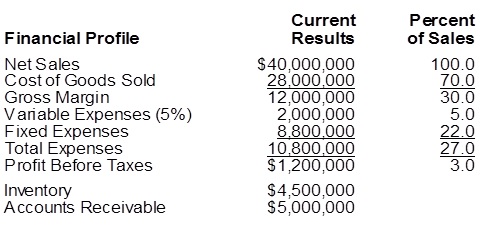

Prior to the economic downturn, the typical MHEDA member had the following financial profile:

Most of the line items in the financial profile are self-explanatory. However, sometimes the breakout between fixed and variable expenses is not fully appreciated.

Fixed expenses are overhead expenses that are relatively constant in the short run, even if sales rise or fall. Variable expenses are those that will change automatically along with sales during the year. Expenses such as sales commissions and bad debts fall into this category. They tend to be a relatively consistent percentage of sales.

Fixed expenses for this typical firm are assumed to be $8,800,000, while variable expenses are $2,000,000 at 5.0% of sales. While these are only estimates, they represent a serviceable approximation for the typical MHEDA member.

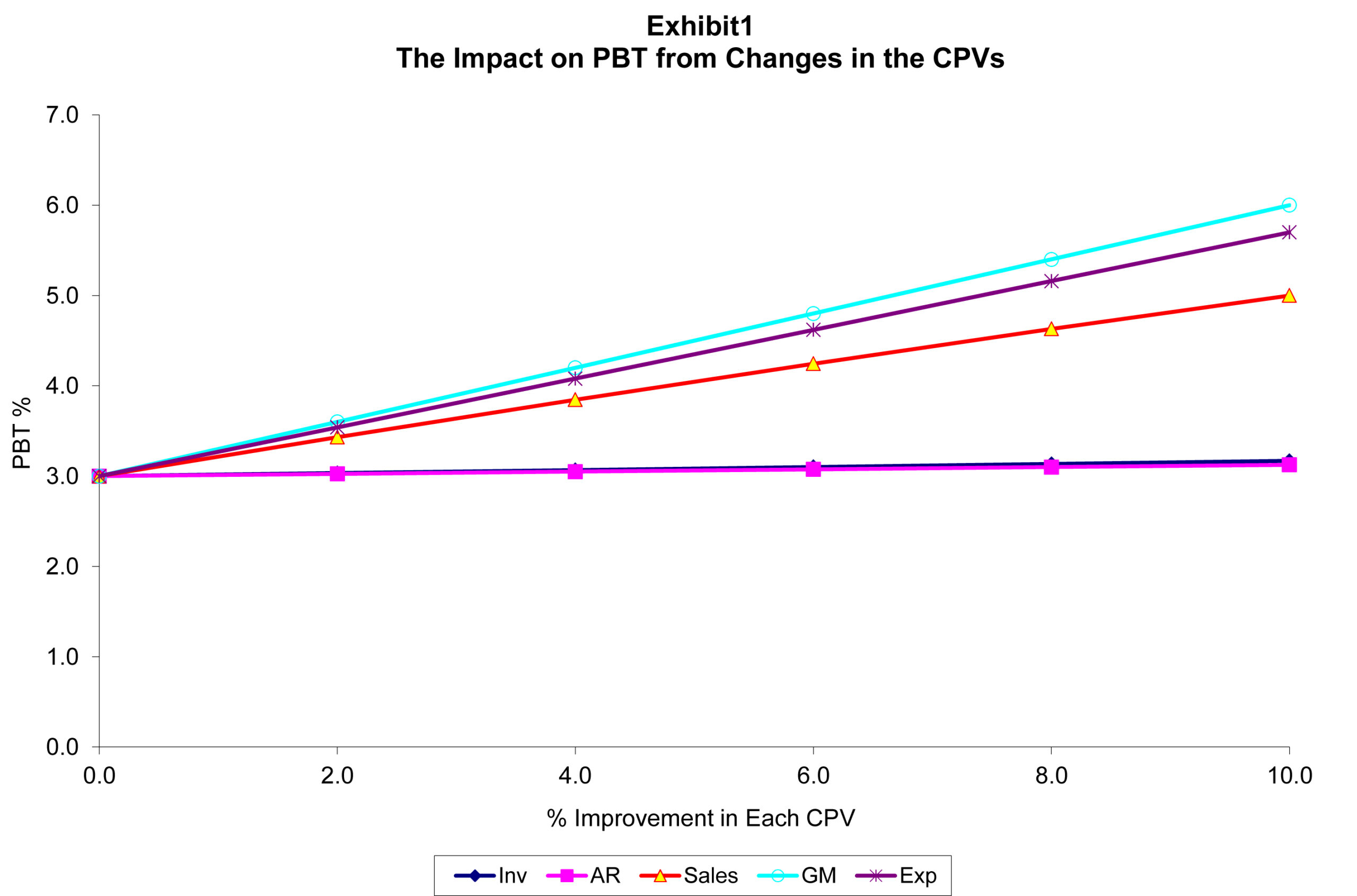

Exhibit 1 takes the information for the typical firm and demonstrates the impact on Profit Before Taxes (PBT) that improvements in each of the five CPVs would have. As can be seen on the left side of the graph, PBT starts at 3.0% of sales. The five lines indicate how much PBT would improve if each CPV were improved anywhere up to 10.0%.

The steepest line belongs to gross margin. The line indicates the change in PBT if gross margin dollars were increased on current sales. That is if current sales could produce 10.0% more margin dollars—a large change—the firm’s PBT rises to 6.0%.

The second most dynamic driver of profitability is reducing the firm’s total expenses, without experiencing a sales decline. At the 10.0% improvement level, the PBT increases from the current 3.0% to 5.7%.

Increasing sales also has a pronounced impact on PBT. However, the line is much flatter than the lines for either gross margin or expenses. That is because as sales increase, the firm automatically incurs additional variable expenses.

At the bottom of the exhibit, reducing either inventory or accounts receivable—without reducing sales—has almost no impact on PBT. This is because the reduction only causes a few expenses to decline, most notably interest.

The reductions in inventory and accounts receivable would have an important positive, short-term impact on the firm’s cash position. However, over time such reductions would do almost nothing for the firm’s PBT.

It should also be noted that many distributors have implemented major programs in recent years to reduce both inventory and accounts receivable. Further cuts may have the potential to begin to impact sales negatively.

Developing Trade-off Strategies

For all its power, Exhibit 1 only examines the CPVs individually and indicates which have the greatest potential to improve profitability. Life, of course, is always about trade-offs. Each of the CPVs needs to be thought of in terms of a matrix of different profit-improvement strategies, where one CPV may improve and another regress.

Despite its one-variable-at-a-time format, Exhibit 1 can provide some valuable insights into how the trade-offs would work most effectively. These insights can be inferred from the slope of the various lines in the exhibit.

Any change in a steep line CPV, say a 5.0% improvement, would increase the firm’s PBT as long as any one other CPV declined by the same exact 5.0%. For example, a 5.0% increase in gross margin would more than offset a 5.0% negative change in inventory (that is an increase in inventory) as the slope of the margin line is much steeper than that of the inventory line.

Similarly, the same 5.0% increase in margin would also offset a 5.0% decline in sales and result in a higher PBT. However, since slopes of the lines are not dramatically different, the improvement in PBT would be modest.

At present, most distributors are concentrating on how to reinvigorate sales. Clearly, additional investments in inventory or accounts receivable that increase sales would sharply increase PBT. Conversely, increasing sales with an offsetting reduction in gross margin dollars produced should be approached carefully. Increasing sales with an increase in expenses is also problematic. Both could possibly reduce PBT.

None of this is to suggest that in the battle to regain sales volume that small, short-term reductions in gross margin or increases in expenses cannot be justified. It does mean that such moves need to be thought through carefully. The lessons in Exhibit 1 must be considered in every decision.

Ultimately, the trade-off challenge is not simply pitting one variable against another. They may be one versus several. What if margin increases, but expenses decrease and sales fall somewhat? The graph loses its effectiveness here.

The Distribution Performance Project provides a free Excel template to help managers work through a variety of scenarios involving multiple CPVs. Go to distperf.com and select the Programs tab. Scroll down to Hands-on Tools and select “What if Analysis.”

Moving Forward

In trying to recover financially it is essential for firms to understand the real economics of their business. Exhibit 1 and the “What if” template can make this easer.

Dr. Albert D. Bates is founder and Principal of the Distribution Performance Project, a distribution research firm headquartered in Boulder, Colorado. He is the author of Breaking Down the Profit Barriers in Distribution, a book that should be read by all operating managers.